Falling Inflation's Impact on Mortgages, Savings, and Investments

Telegraph Money details how declining price increases will affect your finances.

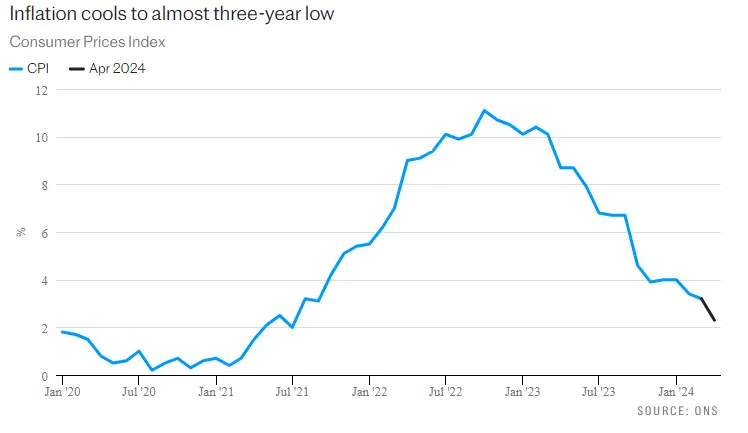

In April, inflation dropped to 2.3%, a welcome decline from March’s 3.2%. Despite this, it remains above the government’s 2% target. The decrease raises hopes for a Bank of England rate reduction over summer, potentially lowering borrowing costs. The current inflation level, higher than expected, delays anticipated interest rate cuts, now forecasted for later in the year. This shift could significantly affect finances, including savings, mortgages, and investments. Telegraph Money provides insight into your options.

What exactly is inflation?

Inflation denotes the pace at which prices ascend, a term commonly employed by economists and governmental bodies. In the UK, inflation is typically gauged by contrasting the price of a specific item with its price at the corresponding time in the prior year. For instance, if a chocolate bar is priced at £1 in April 2023 and escalates to £1.04 in April 2024, the price has surged by 4%, indicating an inflation rate of 4% for that item.

However, accurately assessing the overall inflation rate entails statisticians employing various methodologies to estimate price increases across the entire economy. The preeminent method utilized by the UK Government and the Bank of England (BoE) is the Consumer Price Index (CPI), frequently abbreviated as CPI. This index, issued monthly by the Office for National Statistics (ONS), computes inflation grounded on a representative basket of goods and services that ONS statisticians revise annually.

How does a decrease in inflation impact your mortgage?

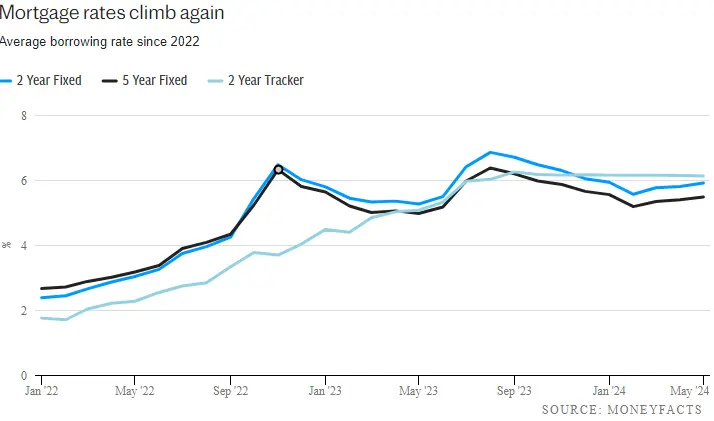

Mortgage rates have stayed high over the past two years, increasing financial strain across the housing market.

For first-time buyers, higher borrowing costs have made it more challenging to enter the housing market, while existing homeowners face a mortgage shock as they transition from ultra-low fixed rate deals to new loans at today’s rates.

According to analyst Moneyfacts, the average two-year fixed rate mortgage is currently 5.93%.

Mortgage rates have stayed high over the past two years, increasing financial strain across the housing market.

For first-time buyers, higher borrowing costs have made it more challenging to enter the housing market, while existing homeowners face a mortgage shock as they transition from ultra-low fixed rate deals to new loans at today’s rates.

According to analyst Moneyfacts, the average two-year fixed rate mortgage is currently 5.93%.

What steps can you take if you need to secure a mortgage?

For homeowners nearing the end of their fixed-rate mortgage, it’s important to remember that you can start exploring your options three to six months in advance and lock in a deal without committing immediately. This way, if rates rise before you finalize your loan, you are protected, but if rates drop, you can choose a better rate.

“Assess your financial situation, check your credit score, and compare current mortgage rates,” advises Mr. Mendes. “Consulting a mortgage broker can provide valuable guidance tailored to your specific needs, such as whether to switch to a new fixed rate, opt for a variable rate, or remortgage with a different lender.”

For first-time buyers, now is a good time to prepare for a mortgage application in case rates fall in the summer, says Ben Thompson, deputy chief executive at Mortgage Advice Bureau. “April’s inflation being just 0.3 percentage points above the 2% target could spark a revival in the housing market. As inflationary pressures ease towards levels the Bank of England finds acceptable, swap rates will likely decrease further, resulting in lower rates for those remortgaging or buying.”

What deals stand out as the best on the market?

For first-time buyers aiming to borrow up to 90% of the house price, notable deals on the market include Lloyds Bank’s two-year fixed rate at 5.22% with a £999 product fee and HSBC’s five-year fixed rate at 5.23% with a £999 product fee.

For homeowners with 25% equity seeking to remortgage, Leeds Building Society offers a two-year fixed deal at 4.79% with a £999 product fee. If you prefer a five-year fixed deal with the same equity, MPowered Mortgages presents an option at 4.82% with a £999 product fee.

For those with 40% equity, whether remortgaging or buying for the first time, Leeds Building Society provides a two-year fixed rate at 4.74% with a £1,499 product fee. Alternatively, for a five-year fixed deal with the same equity, Lloyds Bank offers a rate of 4.75% with a £999 product fee.

How does decreasing inflation affect your savings?

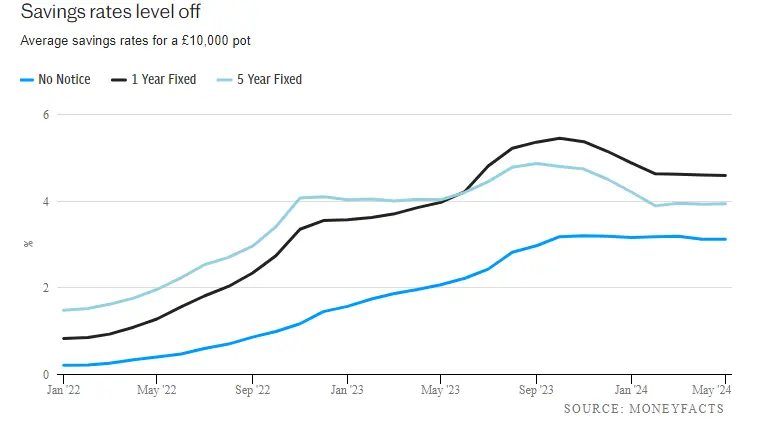

Decreasing inflation presents both positive and negative implications for savers. With inflation standing at just 2.3%, it’s relatively simple to surpass it with prevailing market rates.

As per Moneyfacts, the average easy access savings rate presently sits at 3.12%, but the most competitive accounts offer yields exceeding 5%.

This trend is advantageous because inflation erodes the worth of savings. In essence, if your savings fail to match or outpace inflation, the escalating prices diminish the purchasing power of your money.

What actions can you take in response to this situation?

Decreasing inflation presents both positive and negative implications for savers. With inflation standing at just 2.3%, it’s relatively simple to surpass it with prevailing market rates.

As per Moneyfacts, the average easy access savings rate presently sits at 3.12%, but the most competitive accounts offer yields exceeding 5%.

This trend is advantageous because inflation erodes the worth of savings. In essence, if your savings fail to match or outpace inflation, the escalating prices diminish the purchasing power of your money.

Nevertheless, it’s improbable that savings rates will remain at these elevated levels for an extended period. Similar to mortgage rates, savings rates typically fluctuate in line with the Bank Rate. Providers may interpret the current dip in inflation as an indication that the Bank Rate will soon decrease, leading them to preemptively lower savings rates.

Last year, as the Bank Rate continued to climb, savings rates reached a peak slightly exceeding 6%. Despite remaining unchanged since August, rates have gradually declined since then in anticipation of an eventual rate reduction.

What deals stand out as the best on the market?

Today’s inflation fall is likely to put further downward pressure on savings rates – so, as a minimum, you should check your current rates and make sure you’re beating the inflation rate.

Planning ahead, it might be a good time to commit to a fixed-term account if there’s cash you won’t need to access for at least a year.

“These cuts could mean lower returns for savers who haven’t secured fixed rates,” said Adam Thrower, head of savings at Shawbrook Bank. “The silver lining? Longer-term fixed-rate savings accounts are gaining traction. These accounts offer the chance to lock in higher, guaranteed returns for a set period, especially valuable for those saving for long-term goals like retirement.”

How does it affect your pensions and investments?

The stock market isn’t directly tied to inflation or the Bank Rate, but since both serve as significant indicators of the economy’s health, they can heavily influence investor sentiment.

Jason Hollands, managing director of Bestinvest by Evelyn Partners, suggested that today’s drop in inflation could benefit investors. “With inflation easing, the potential for lower borrowing costs, and an improving UK growth outlook, UK equities, especially smaller and medium-sized companies focused domestically, could see support,” he explained.

“This could present a favorable entry point for investors, as UK equity valuations remain comparatively low compared to global equities, evident in the recent surge of bids for British companies by foreign buyers and private equity funds.”

Despite challenges such as a lack of IPOs and companies listing on overseas exchanges, Hollands highlights that better economic conditions, increased share buybacks, and a flurry of bids are generating numerous investment opportunities.

However, low inflation might impact retirees or those nearing retirement, particularly concerning bonds. Pension “lifestyling” strategies often transition toward less risky investments as retirement approaches to mitigate market volatility, typically involving an increase in bond holdings.

Bonds tend to become more attractive during periods of rising inflation as their income value in real terms increases. While this is beneficial for existing bondholders, it can pose a costlier proposition for those yet to purchase bonds.